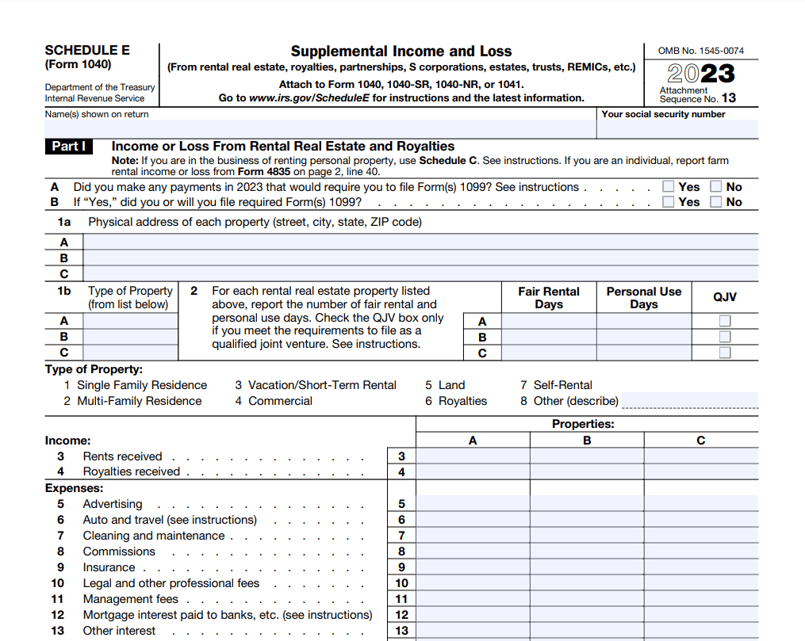

2024 Form 1040 Schedule E Form – As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule E Form

Source : www.turbotenant.comIRS Form 1040 Schedule B 2021 Document Processing

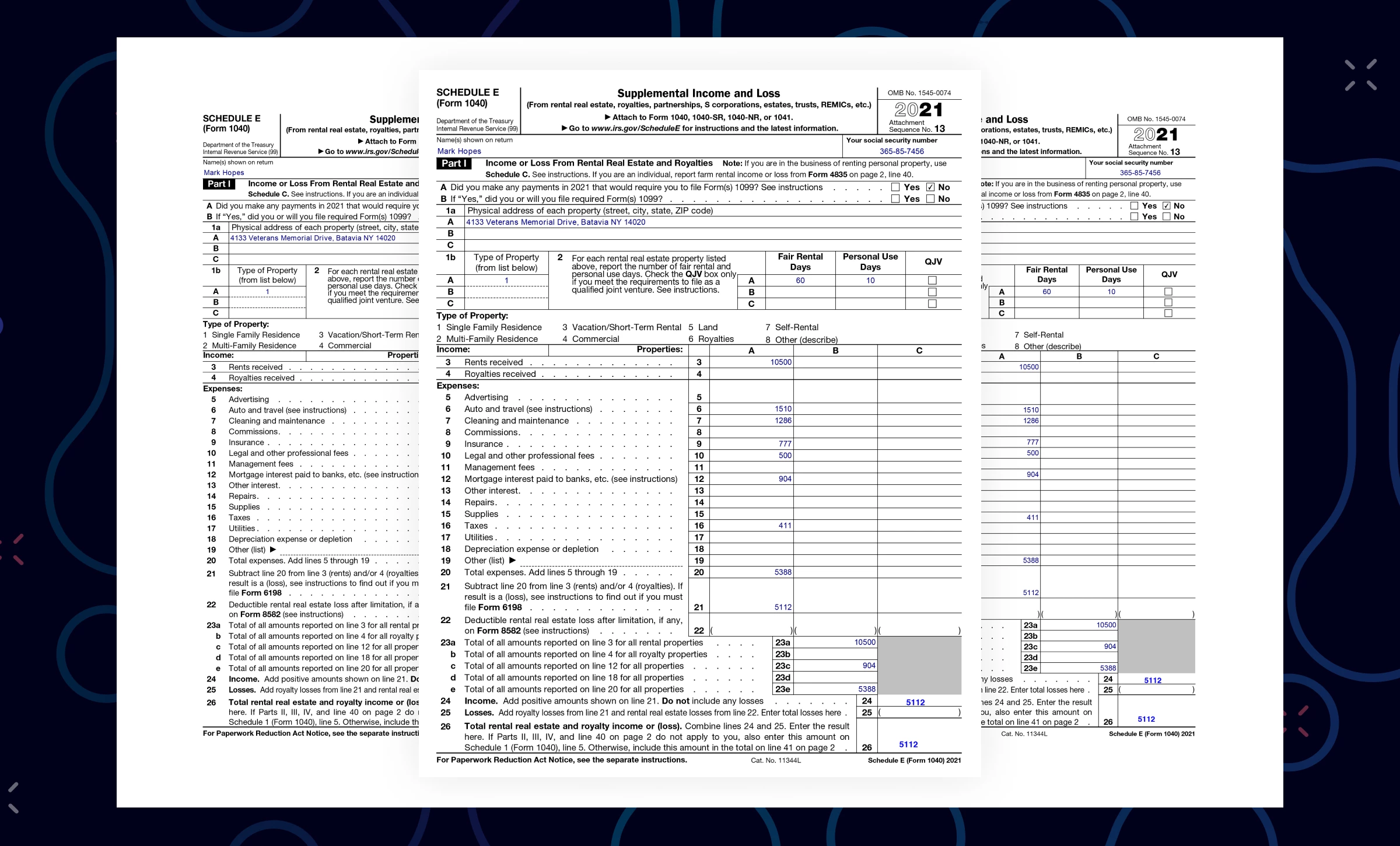

Source : www.ocrolus.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

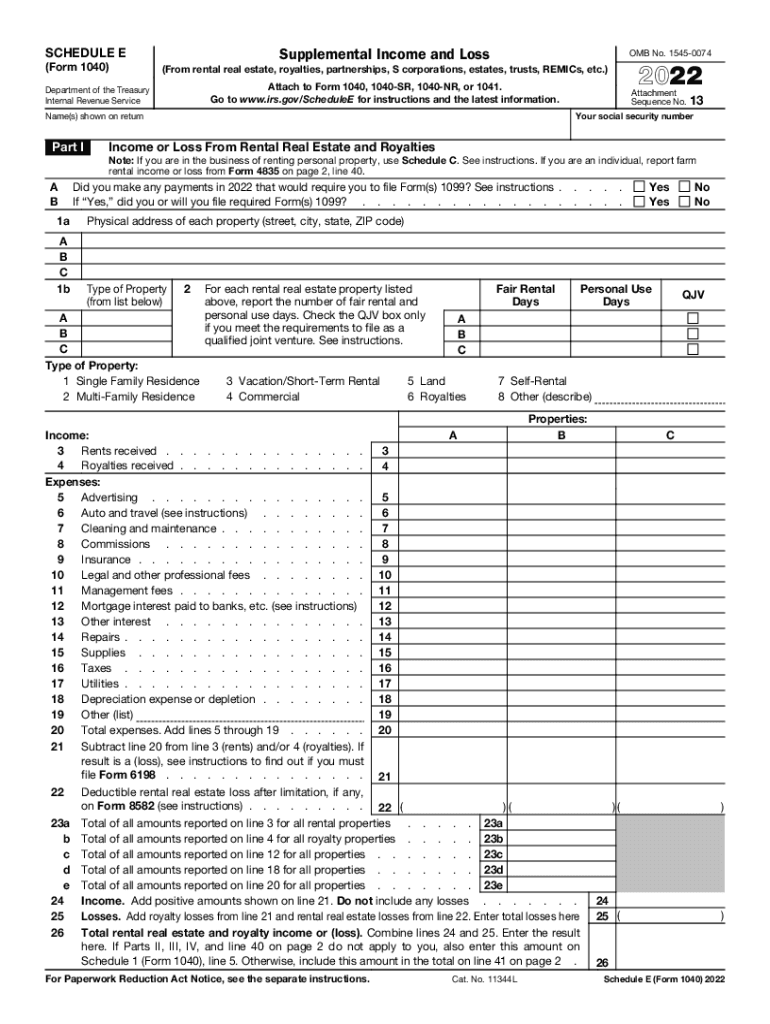

Source : www.reddit.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comTax form schedule e: Fill out & sign online | DocHub

Schedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.nelcosolutions.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.com2024 Form 1040 Schedule E Form Mastering Schedule E: Tax Filing for Landlords Explained: Form 1040, formally known as the “U.S. Individual Rental income (you may also need to file a Schedule E). Farm income. Unemployment income. Educator expenses. Deductible moving expenses. . Employees can only deduct their clothing expenses as miscellaneous uniform deductions on their Form 1040, Schedule A. They must also attach IRS Form 2106, Employee Business Expense or IRS Form .

]]>